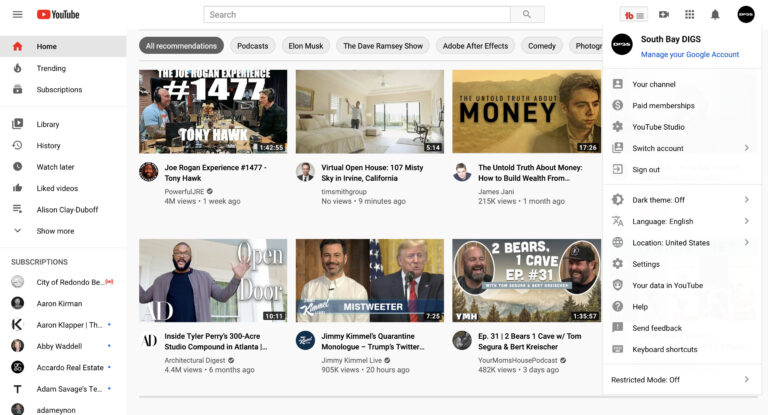

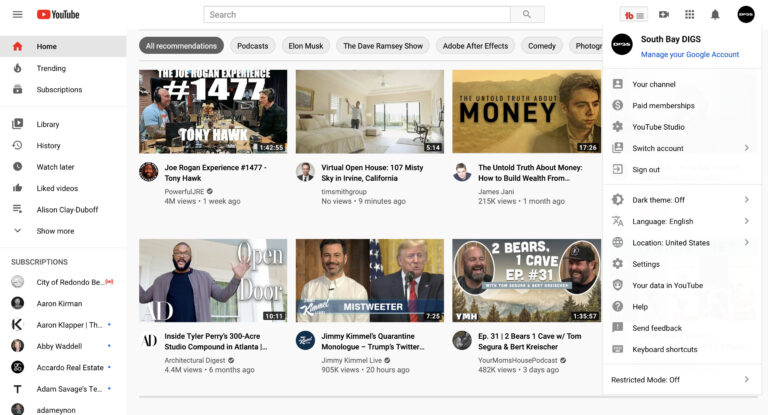

A Killer YouTube Guide That Will Jump-Start Your Views

In this YouTube guide, we’ll go step-by-step and show you how to upload a video to your YouTube channel and help your video stand out.

In this YouTube guide, we’ll go step-by-step and show you how to upload a video to your YouTube channel and help your video stand out.

Palo Alto, California-based global blockchain real estate marketplace, Propy, Inc. is launching a pilot program to record real estate documentation using blockchain technology in South Burlington, Vermont, a state that is increasingly known for being friendly to blockchain development.

According to a Trulia research report, $1 million may no longer get buyers into the luxury home market – its more like $5 million as the new bar for luxury living.

According to eMarketer, global ad spending is predicted to reach $583.91 billion in 2017, with digital ads making up about 38% of that total. Unfortunately, most of those ad dollars will go to waste – never reaching their intended and most relevant audience, and thus offering no return on investment.

The emergence of “iBuyers,” institutional investors utilizing technology to become the largest purchasers of Americans’ most significant assets, could significantly influence real estate market dynamics, including pricing and commission rates. The iBuyer trend is still in its infancy, but it is set to revolutionize the real estate industry, driven by a drive to make the home-selling process more efficient and lucrative.