Decoding the Financial Narrative Puzzle

I’ve been paying a lot of attention to the economy and financial markets recently – more than usual.

Why?

First, to gain knowledge – the more, the better in my book.

Second, I’m a small business owner – so it’s my fiduciary responsibility to my team members, clients, myself, and my family to be on high alert when things start to change in the market. By doing so, it also positions me proactively versus reactively.

Third, something BIG in the works.

What is it?

I don’t know. (Just like everyone else.)

But what I found equally amusing and alarming at the same time is when you listen to all the financial/Wall Street/economic chatter out there from the so-called “experts” – you’ll find that it’s just one cognitive bias after the next.

Hence the title of this little ditty – when lots of people “expect” things to go a certain way… that’s a sure-fire sign that something unexpected is about to happen or is happening right before our eyes.

It’s almost humorous how hard the market pundits work to bend, twist and tweak their narratives according to their own bias – finding any obscure data point to prove their point.

Somewhat related to what Warren Buffet says about when to be greedy or fearful:

“A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful.“

But what if it’s a 50/50 split between those who are feeling greedy and those who are feeling fearful?

That’s what I’m seeing out there in ALL markets today.

The stock market, real estate, mortgage, labor market, bank sector, manufacturing sector – you name it, you’ve got heavy-handed cheerleaders on each side of the table telling you that now is the opportune time to “do this” or “do that.”

Half of the room is “the sky is the limit!” and the other half is “never seen before doom and gloom coming soon!”

So, what’s a sane and reasonable person do?

Take a deep breath and listen with intent to all that you hear!

Look at the “context” within “narratives” for clues and all will be revealed.

Take Wall Street for instance.

It’s just a ginormous online casino.

To keep it going – you need action.

You can’t win if you don’t play.

So, you play.

Every industry and market segment has its version of the “dealers.”

They deal the cards and control the capital.

There are winners. There are losers.

It amuses me to no end listening to all the “expert” narratives out there – they are everywhere.

I’ve gotten pretty good at sniffing these skunks out – when you understand that it’s all a game and you’re just a player like everyone else you’ll begin to see the biased narratives of the day, and the odor will be apparent.

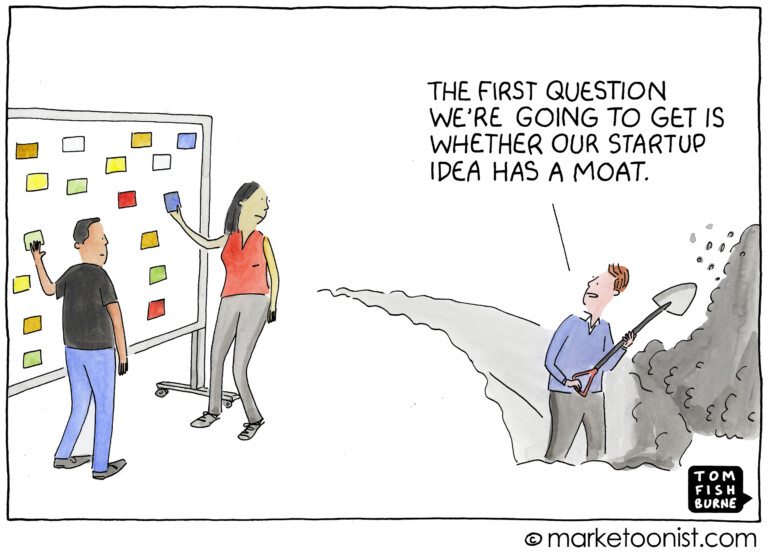

I subscribe to the “no one knows anything” theory – and it’s blissful because it keeps “the whiteboard of opinion” clean, acting like a giant eraser for all the cognitive bias out there.

And best of all, when you subscribe to the “no one knows anything” theory you take the pressure off yourself in trying to determine “who is right?” and “who should you believe?”

And why it is best to keep learning and get exposed to all opinions so you can start to make sense of the who is trying to play “pit boss,” who is playing “dealer” and what “game” people are playing.

The Perma-Crisis Era

Narratives tend to be more persuasive when attached to a crisis.

Like FOMO, or “fear of missing out,” or the “once in a lifetime opportunity” peddlers – the more emotional triggers they can play on the better.

We are living in a time of the “perma-crisis.”

After all, why let a good crisis go to waste?

Crises work to expand and accelerate the narratives of the day in play.

I watch CNBC in the morning to see what’s happening in the stock market and watch market “experts” preach “bull market this” or “bear market that” with utmost conviction.

Just reinforces the notion – “no one knows anything.“

Any why I gave up years ago trying to play the “smart real estate market guy” who has to have an opinion of home prices, etc.

These days, I’m keeping my giant whiteboard clean.

Cause “nobody knows nothing.“

But I am preparing for the unexpected by closely following the prevailing opinions and situational narratives out there and sense things are about to change.

It’s inevitable.

So, how can we all get ourselves in the proper state of mind dealing with uncertainty and that change is inevitable?

Let’s play a little game.

It will be fun and brighten your day a little – ready to play?

Cool.

There Are Two Buckets

Each bucket contains 8 words that have great significance in what they mean and how they impact your mindset and where you end up in your journey through life.

You get to choose one bucket to carry with you on your journey to wherever you are going or want to go.

Bucket 1

Scarcity, Cost, Ego, Security, Competition, Status, Transaction, Past

Bucket 2

Abundance, Growth, Investment, Future, Transformation, Opportunity, Collaboration, Capability

Choose carefully.

You’ll want the right ones in your bucket when the unexpected reveals itself.