The Unlikely Link Between Champagne and Household Income

Can Champagne sales predict the health of the U.S. economy?

How about the average household income for Americans in the coming year?

Well, according to research by the Planet Money team at NPR, consumption of Champagne can predict, with 90 percent accuracy, the average American household income a year later. (Source NPR.org)

The theory is based on the obvious assumption that the consumption of luxury items tends to be sensitive to changes in income levels.

But what if this obvious indicator was spot on in predicting the overall health of the economy?

The Planet Money researchers tracked Champagne sales and average household income from 1996 through 2011 and found a surprisingly accurate correlation.

It turns out that the line for inflation-adjusted household income perfectly tracked how much bubbly Americans downed the year before.

And, not surprisingly, the peak Champagne consumption years were in 1999 and 2007 – right before the dot.com and housing bubbles were about to burst.

Now, this is one data metric that may be worth tracking, wouldn’t you say?

So, let’s dive into some numbers for further analysis and economic palm reading.

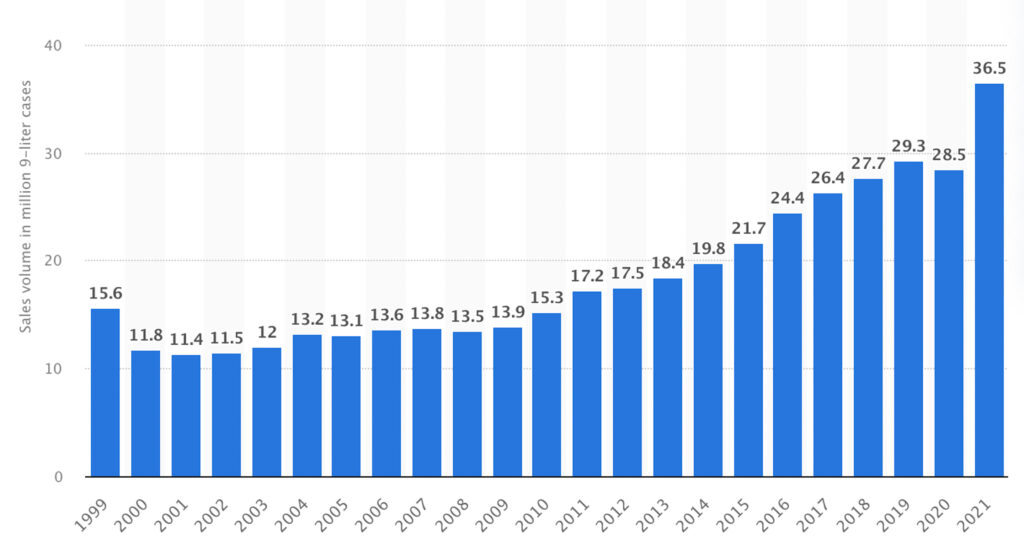

Check out the chart below courtesy of statista.com. *Statista 2023

Per the chart, you can see that Champagne sales reached a peak in 1999, then dropped and remained lower until 2007 when it peaked again, and then – well, looks like the average American was suffering from Champagne dehydration and has been unable to quench their thirst as consumption has gone hyperbolic since then. (Just like every asset class, i.e., stock market, real estate, etc.)

What about 2022?

Well, here is where things get a little weird, and perhaps, scary if this magical little predictor is indeed accurate.

Here’s a headline from an article dated April 7, 2023, from the Robb Report that perfectly sums it up…

“Champagne Sales to the U.S. Have Increased 31% Since 2019. More than 33 million bottles of bubbly were shipped to the states last year.”

Did you know that the U.S. is the top export market for Champagne and sales soared by 19.4% to $998 million in 2022?

Warning: Champagne sales just hit an all-time high in the U.S. last year.

To make matters worse and more ominous for the global economic outlook consider that in 2022, for the first time in history, purchases of sparkling wine/champagne topped $6.5 billion with total shipments of a record 326 million bottles!

Yikes.

Batton down the hatches folks, we may be in for a rough ride ahead.

A.I.

Can’t escape the rise and rational exuberance around A.I. these days, and for good reason.

A.I. is going to change our world as we know it today – forever changing society and everything in it.

But I can’t seem to escape the associated paradox here.

The A.I. pundits and the corporations that are leading the charge are foaming at the mouth over how transformative it will be for productivity and profits.

The adoption of A.I. and associated tech will further drive down costs, increase efficiencies, and exponentially allow the world to “do more” with “much less.”

The Wall Street pimps are pumping the A.I. narrative on how great this will be for corporate earnings.

I get it.

That’s the no-brainer part of the equation.

But what happens next? And then after that? Then what?

If you think through the “do more” with “much less” equation a bit – you’ll see the A.I. tradeoff.

What’s the cost?

People. Jobs. Paychecks?

In some cases, potentially entire segments of industry.

The blathering idiots out to make a quick buck are shortsighted – they don’t think and care about what comes next, the dominoes at the end of the line.

So, who really cares if Microsoft’s earnings 10x in the next 2 years if people can’t afford to buy their products or services?

Maybe this is the final frontier for the tail-wagging-the-dog syndrome.

The almighty A.I. behemoths are ultimately being controlled by the less important regular folks who are unemployed and unable to pay for their lavish artificial artifacts.

A.I. essentially makes life as we know it – “perfectly efficient.”

After all, A.I. doesn’t need to eat, sleep, shower, put their kids through college, and save for retirement.

It just needs to exist.

And then comes the ultimate irony…

…when A.I. itself deems everything else (humans, corporations, governments, etc.) inferior and worthless in the overall scheme of things.

Sounds like this would make a good movie. Hmm.

But unfortunately, we may already be living it.

To clarify – I’m not saying A.I. is intrinsically bad or malevolent here, just pointing out the inherent disconnect I see in what the potential outcomes are here.

On the positive side, I can totally see A.I. transforming healthcare and massively accelerating the treatment and cure of diseases, etc.

I mean, just imagine having all the academic and real-life data for health sciences all in one database and hundreds of thousands of Albert Einstein-like intelligences crunching the data and exponentially learning and getting better and more accurate by the hour and doing this twenty-four hours per day, every day.

The possibilities are endless.

A.I. will be able to solve problems us humans couldn’t imagine solving in no time.

And also solve problems that we don’t even know exist yet…

…and that’s where this gets “sci-fi-esque,” both interesting and scary.